In the course of just a few weeks, the COVID-19 pandemic has redefined large swaths of the American retail landscape – forcing brands to face a crisis of survival and relevancy that will have long-term repercussions for the shape of the retail industry.

The commerce crisis

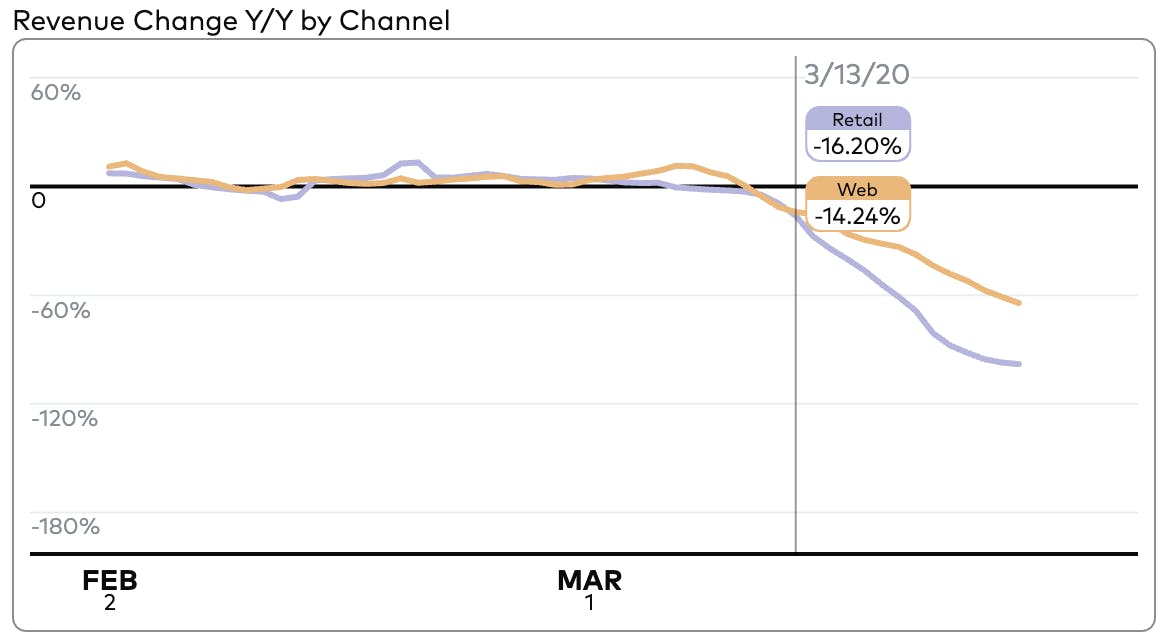

Retail brands began experiencing softening demand as early as March 1st, as an initial boost in e-commerce masked the early declines in-store purchasing. Since then, stores have closed their doors to the public as the country has issued directives for non-essential workers to shelter in place.

We work with over 100 brands spanning publicly-traded global companies to high-growth pure-play e-commerce firms across a variety of discretionary retail categories including fashion and apparel, footwear and accessories, and beauty – along with food and beverage. We built a dynamic tracker to analyze the impacts of the pandemic on retail. As of March 26, demand is down 86% relative to last year, and the data suggests that, unfortunately, the industry hasn’t quite yet reached the bottom.

July 2021 update: we've sunsetted the Retail Monitor and it is no longer accessible.

Here’s what you need to know:

Overall retail demand down 86%

Losses driven by closure of retail stores, with online revenue down 64%.

Mobile orders down only 18%; bright spot in social

Mobile orders down less than 25% of overall; social sees 2-day improvement, overtaking email as the most resilient non-organic marketing channel

Read on for a week-by-week analysis of trends and changes, followed by our recommendations.

How customer behavior changed, and what that means for the industry

Sunday, March 1

30 US Cases | First case in NY, Airlines waive fees, states begin Emergency Declarations

Existing customers start to stock up online, begin putting off luxury purchases

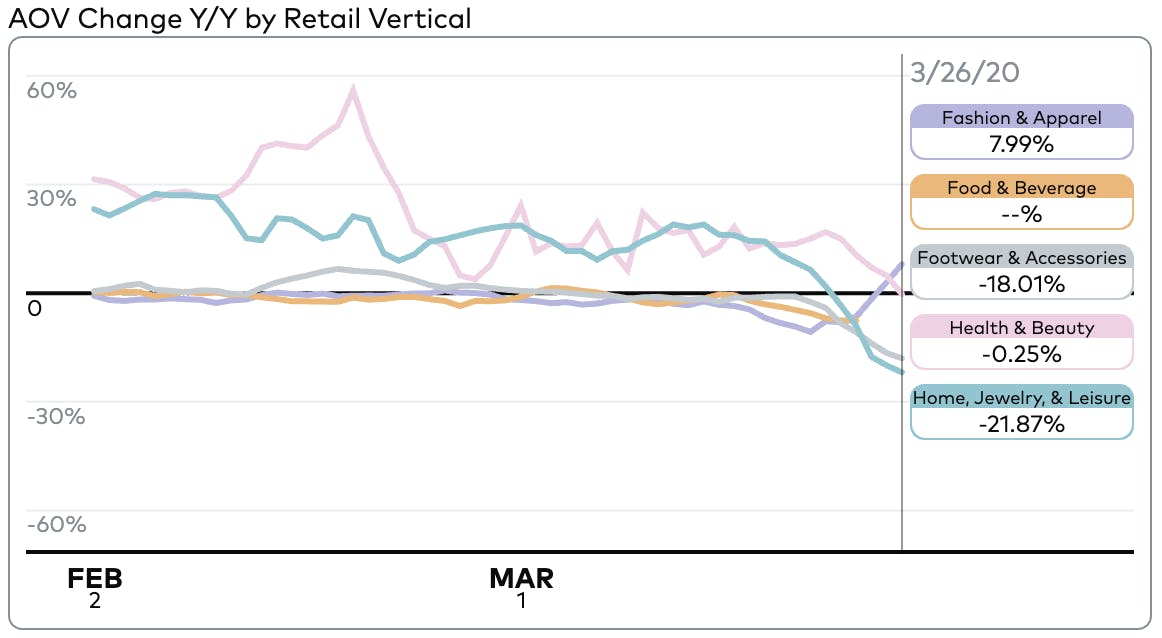

On March 1st New York announced its first case of the coronavirus, airlines began waiving change fees, and states started pursuing policy actions to slow the spread of the virus. Consumer behavior quickly began to change across the country - demand shifted to digital channels, primarily driven by existing customers making more frequent orders with smaller Average Order Value (AOV). This was especially prevalent across Fashion & Apparel and Food & Beverage retailers. Home, Jewelry, & Leisure vertical immediately saw year-on-year revenue start to decline and in-store purchasing remained flat for another week.

Friday, March 6

282 US Cases | CDC issues warning for older adults, States begin Emergency Declarations

States with Emergency Declarations: 4

Online revenue peaks due to purchases from existing customers, primarily on mobile

States began issuing Emergency Declarations near the end of the week to ease their access to federal aid and enable quick decisions (like group bans and restaurant restrictions) later on. As things felt a little closer to home, even existing customers began to show signs of postponing purchases, ending the temporary growth. All verticals — including Food & Beverage — experienced revenue decline for the next several days.

Monday, March 9

560 US Cases | Italy puts 25% of population on lockdown, “Black Monday” — DOW drops over 2,000 pts

States with Emergency Declarations: 9

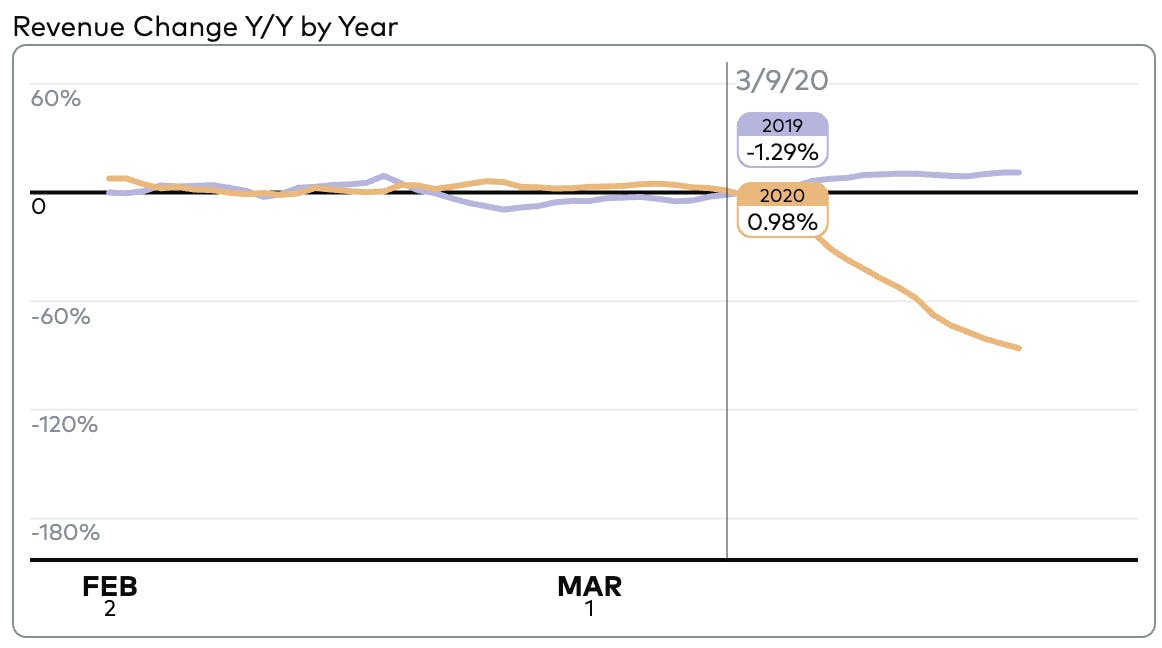

Last day of growth as mobile revenue begins to decline; new customer acquisition falls Y/Y

Monday, March 9th was the last day of positive Y/Y revenue in 2020. That morning, oil prices crashed to a four-year low and the DOW ended the day down 2,046 pts. Customers responded to the vote of uncertainty and online revenue neared overall decline, ending over a week of growth.

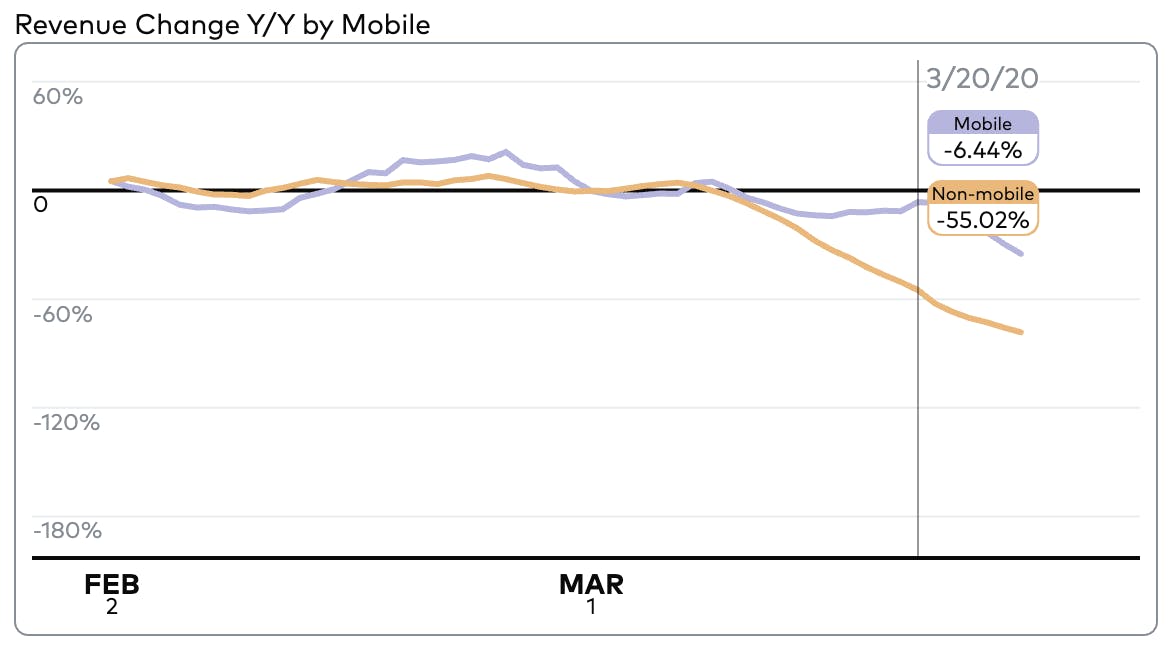

Although stores had not yet begun to close, retail customers were already beginning to avoid in-person shopping on their own. New customers were the first to go, but many existing customers were still purchasing more online than they were the prior year. But mobile revenue dropped Y/Y, starting an early but (comparatively) moderate decline.

Wednesday, March 11

1,267 US Cases | US suspends travel from Europe, 43 States report cases, States begin school closures

States with Emergency Declarations: 26

Overall revenue down for the first time Y/Y as loyal customers start staying at home; initial surge of online orders slows while panic-buying for Food & Beverage begins

Once schools began to close and the first wave of customers started working from home, e-commerce’s tenuous growth gave way to Y/Y decline. This shift marked the first overall decline in revenue for Fashion & Apparel and the Retail cohort began to experience overall revenue decline. Notably, this transition was marked by the first declines from existing customers, who had previously fueled the shift to digital and who tend to drive the majority of revenue for brands. Following case expansion and school closures customers shifted their spend to Food and Beverage retailers, who saw a dramatic increase in both revenue and acquisition (although it is likely that these “new” customers were shopping in-store anonymously all along).

Friday, March 13

2,660 US Cases | National State of Emergency, first Bar & Restaurant bans implemented

States with Emergency Declarations: 47

States with School Closures: 13

Declines accelerate, bright spot as existing customers start shopping mobile/direct

This marks the acceleration of true decline. Case numbers sharply increased in the US as testing proved the virus had been spreading undetected locally. 11 more states announced school closures overnight. Parents began working from home and major gathering places - in particular, bars and restaurants - started shutting their doors and furloughing employees. Retail stores gradually followed suit, and over the next 7 days Y/Y revenue would plummet another 50%.

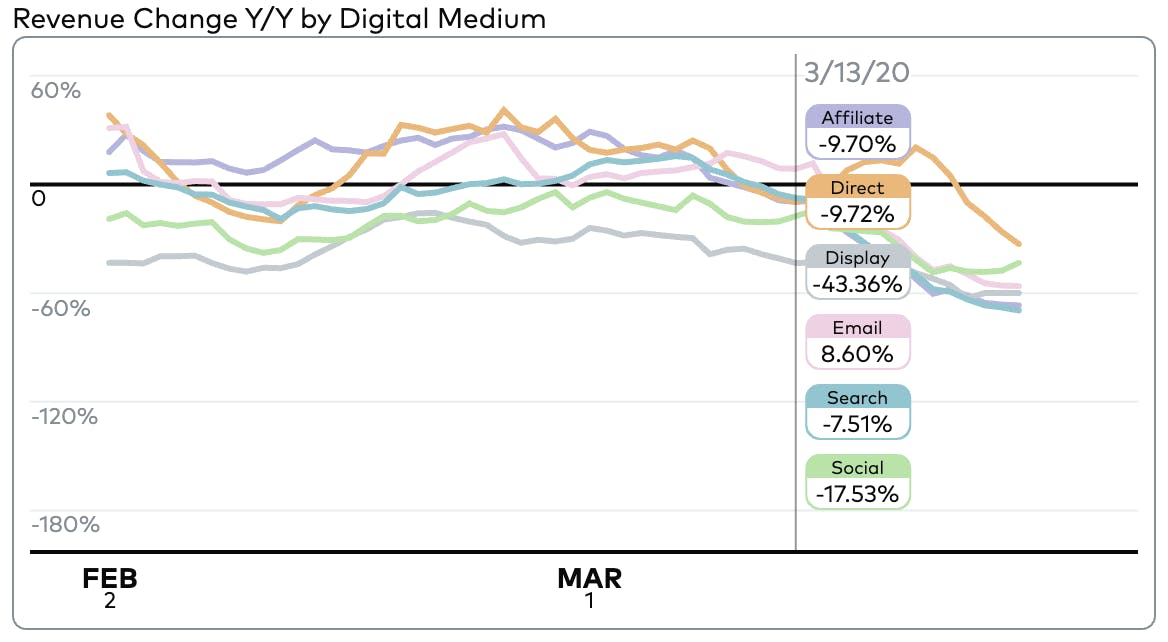

Online purchasing fell along with it, likely driven by rising unemployment, a general shift in consumer spend toward necessities, and new challenges around blended purchasing models like buy online/pickup in store. And as brands began limiting marketing ad spend and focusing instead on relationship-building, search and affiliate-driven demand would fall over 50%, leaving direct referrals as the primary source of online revenue - particularly for existing customers.

Many orders shifted to mobile as consumers stayed and browsed at home. But as orders increased, basket sizes fell and the shift did not significantly impact the broader trend.

Until now, the Midwest had experienced a period of relative resilience while existing customers continued to shop and store closures lagged behind other regions. As confirmed cases spread to the Midwest and their states quickly adopted similar emergency measures, the Midwest began seeing similar declines to the rest of the US.

Friday, March 20

18,170 US Cases | 3.3M Americans file for unemployment, New York mandates non-essential workers stay home, California residents shelter in place

States with Emergency Declarations: 50

States with School Closures: 50

Continued decline driven by store closure and unemployment and moderated by signs of life in mobile

By March 20th, Retail revenue had declined 58% Y/Y. Businesses that weren’t yet closed began doing so en masse, causing 3.3M Americans to file for unemployment in a single week. The rest of America was starting to work from home. For some, this was their first weekend in quarantine and an increase in screen time led to a relative boost in mobile ordering. This time the increase was not accompanied by further declining AOV, meaning that overall revenue declines began to slow to ~3% per day. And Direct traffic (which had experienced recent growth) began to decline as brands eased back into marketing their steep sitewide discounts via social.

Thursday, March 26

65,201 US Cases | US Senate passes $2 trillion economic relief package, NYC becomes the US epicenter

Pace of decline slows amid bright spot in social as brands embrace discounts

By the end of March our retail industry benchmark shows a total decline of 86% (35% for mobile). But brands are doing what they feel is necessary to move the needle; recent increases in Fashion and Apparel average order value may indicate that sitewide discounts are swaying some customers and incentivizing larger purchases. Unfortunately, this minor uptick hasn’t yet resulted in a flattening of the decline. But it proves that demand exists, if you’re willing to sacrifice what is left of your margin to get it.

Bright Spots: mobile devices, email & social

Amid the heavy news of declining revenue, there exist a few opportunities for growth (or more realistically at the moment, mitigation):

Customers are still making purchases via mobile devices (albeit with typically lower AOV than normal).

Social shows signs of life, helping with both acquisition and retention and growing AOV +5% Y/Y. Data suggests this is from mobile shoppers responding to sitewide discounts

E-commerce only brands, while still suffering, are only down 63% (omnichannel brands down 89% Y/Y)

Our Recommendations

Now is the time to lean into customer-centricity:

Explore the data you have. For many brands, roughly 80% of revenue is driven by 20% of customers. Revisit customer behavior to see how things have shifted during the pandemic. Who are your best customers? Which of them are returning and which ones aren’t? Are some products more or less popular right now? Are people shifting behaviors around discounts and promotions?

Focus on bright spots where they exist. Industry-wide areas of opportunity are centered around existing, loyal customers who are shopping directly on your website or engaging via owned channels like email. Yours may be slightly different. Find them, then (in addition to relationship-building) focus your media budget on engaging and retargeting these customers, particularly on mobile.

Differentiate your customer experience. Find light-lift personalization efforts that make your high value customers feel appreciated. If possible, avoid the temptation to discount everything; save targeted discounts for the folks who wouldn’t purchase otherwise.

Use this opportunity to better know your customers. There’s a good chance that your “new” online customers were buying in-store all along. Take advantage of the shift to digital engagement to alleviate prior blind spots and learn more about customer behavior.

Prepare for recovery. Yes, the numbers are bleak. And it’s likely that these trends will get worse before they get better. But they will get better. And while your customers are hunkering down, build a plan for how you intend to win them back. Start with your best customers and the bright spots you’ve uncovered, and go from there.

Check back with the Amperity blog for weekly updates on how the retail market is faring, or register with our Covid-19 Retail Monitor (update: we've now sunsetted the Retail Monitor) for insights in your inbox.