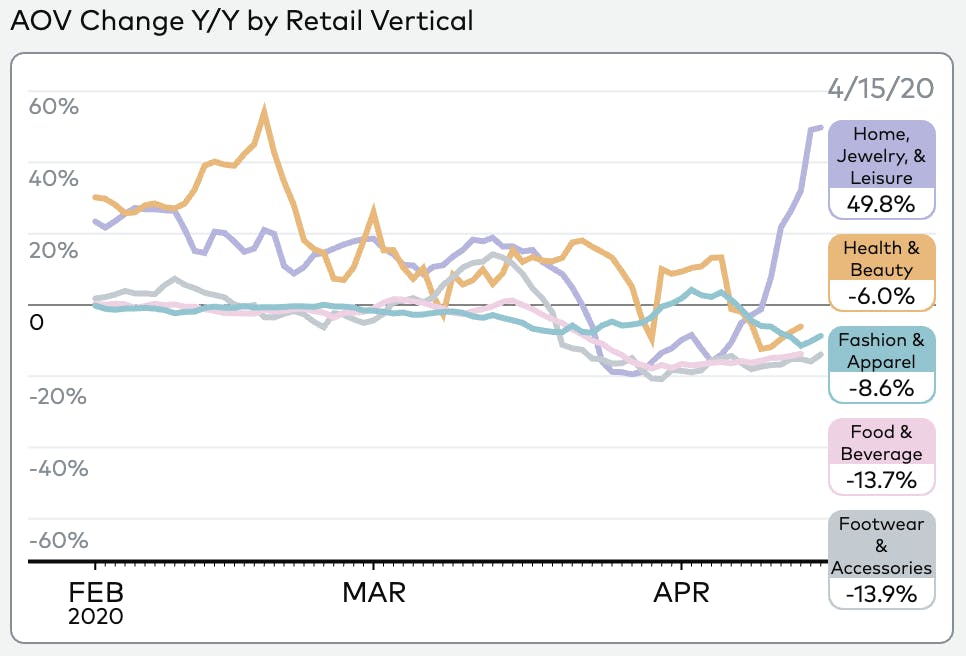

Up to now the data have shown that American consumers are limiting their retail spend in favor of everyday essentials. But recent trends tell a heartwarming story: consumers, particularly men, are still shopping for Mom this Mother’s Day (or for wives who are also moms). So while overall revenue remains down Y/Y, basket sizes for the Home & Jewelry vertical have increased all through April (+49% Y/Y) - evidence that even during a downturn with considerable uncertainty and high rates of unemployment, holiday-driven demand still exists. For brands approaching a seasonal or holiday period typically associated with organic growth, we recommend pulling back on COVID-oriented sales strategies and using that budget for targeted offers instead.

Here are some high level trends from the Retail Monitor:

Overall Revenue down 77% as Mobile falls Y/Y.

In the month immediately following COVID restrictions and stay-at-home orders, mobile was a bright spot for Retailers, growing 7% as stores closed and nearly every metric (including overall e-commerce) declined. This growth peaked at the start of April and has fallen steeply since: as of writing, mobile is down 44% Y/Y. Yet mobile still remains the most successful channel on which to reach customers, and we will continue to monitor its performance.

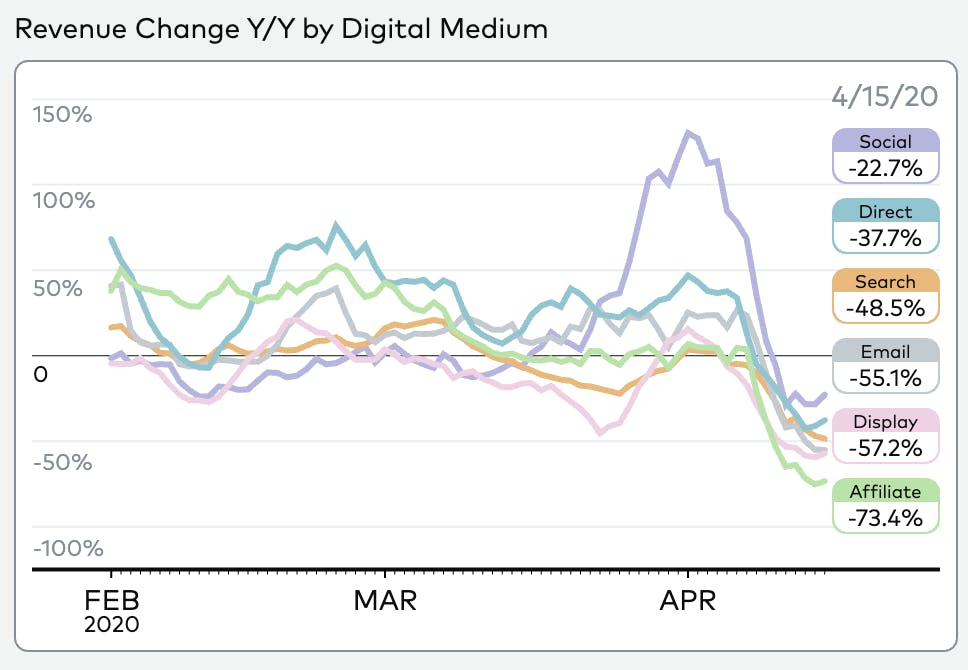

Social revenue sharply declines, but remains the best performing paid channel

As the crisis unfolded, mobile and social gained traction as the best channel and digital medium to reach customers staying at home. This trend was further fueled by large-scale sales as brands tried to shed inventory. But recent data show that this infusion of demand has declined across the board. And although social is still outperforming other channels, its rapid gains have proven temporary.

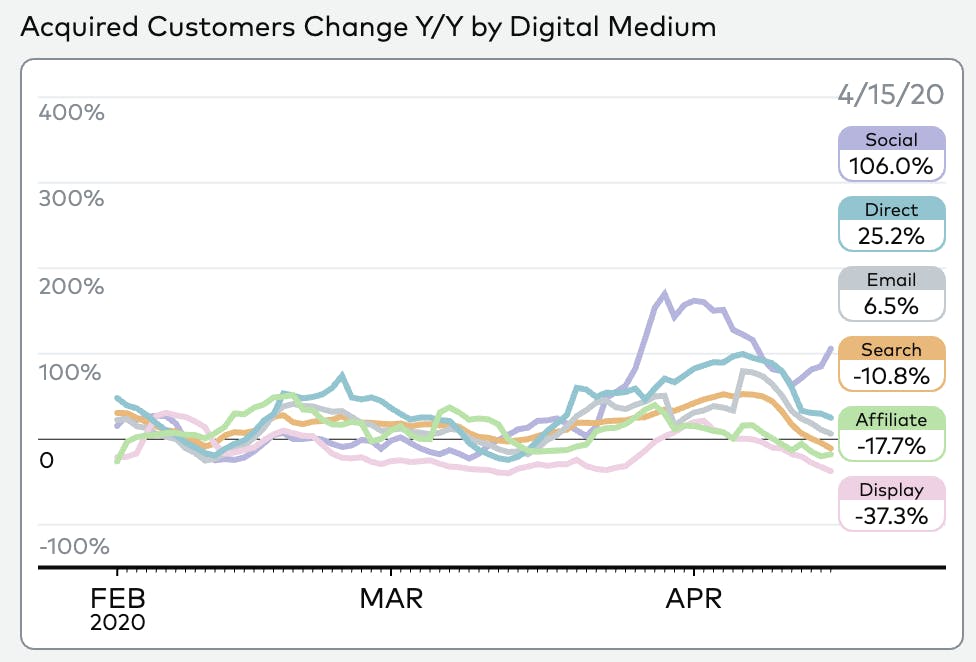

Customer acquisition, once a bright spot, shows evidence of decline in all channels and mediums except Social

Year over year customer acquisition has consistently outperformed relative to existing customers, but the growth experienced in many channels and digital mediums has shown recent decline. Mobile and social remain the biggest positive drivers of customer acquisition: mobile is up 12.5% and social is up 106%. Worth noting is that email is a secondary driver, which indicates that many of these customers aren’t net new to your brand (for instance, they may have subscribed to your emails or joined your loyalty program), they’re just making their first online purchase.

We also ran live Q&As with our analysts about the trends and insights during this series. Stay tuned!