We built a dynamic tracker to analyze the impact of the pandemic on retail, using data from more than 100 North American brands. We'll be sharing updates and new insights on a regular basis. You can find our first installment recapping data from the past few months here.

July 2021 Update: We've now sunsetted the Retail Monitor and it is no longer accessible.

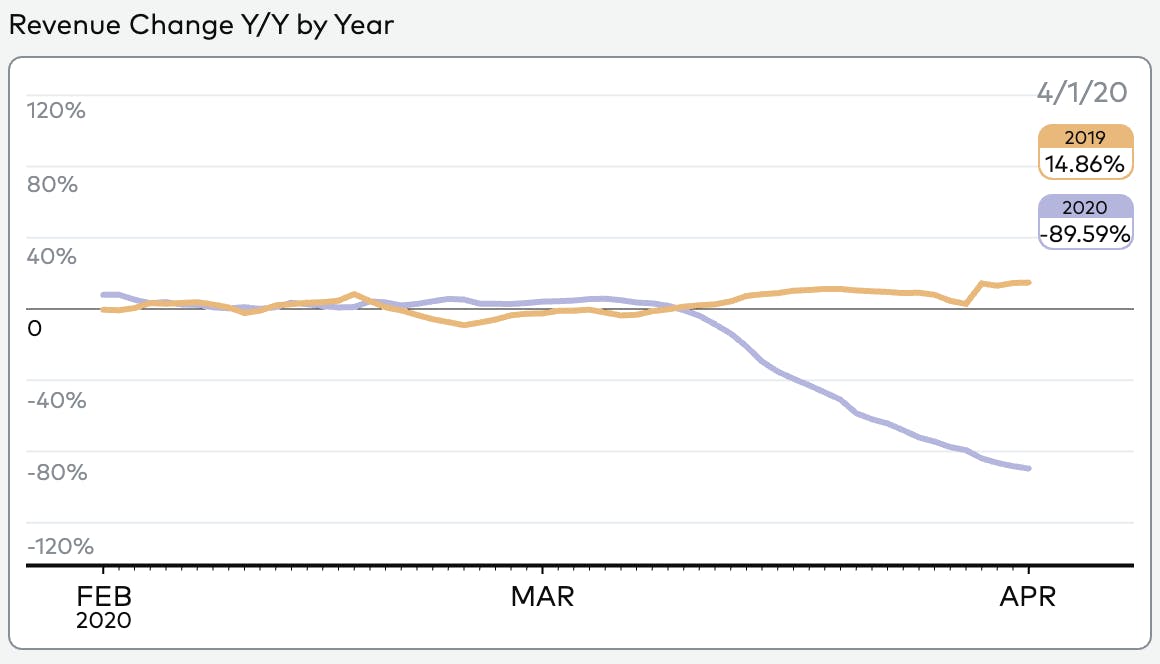

E-commerce revenue continues to decline.E-commerce revenue is down ~75%, accelerating again as the US extended social distancing guidelines to the end of April. Overall retail demand has fallen ~89% year over year (Y/Y).

Brands are returning to social to drive demand, and it’s working (to a degree). Investments in social ads and site-wide discounts are generating higher average order value (+7% Y/Y), but do not appear to be slowing the decline of orders (-90% Y/Y).

Mobile remains the least affected channel. As customers spend more time on their phones, mobile revenue dropped only 58% Y/Y compared to 77% for overall e-commerce.

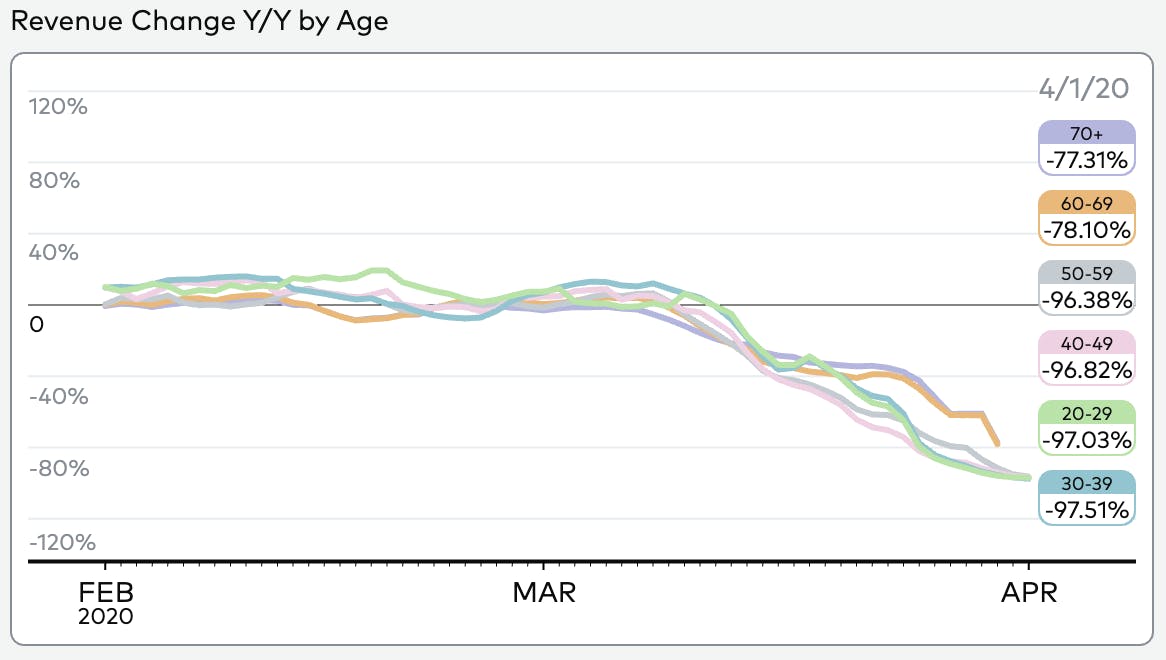

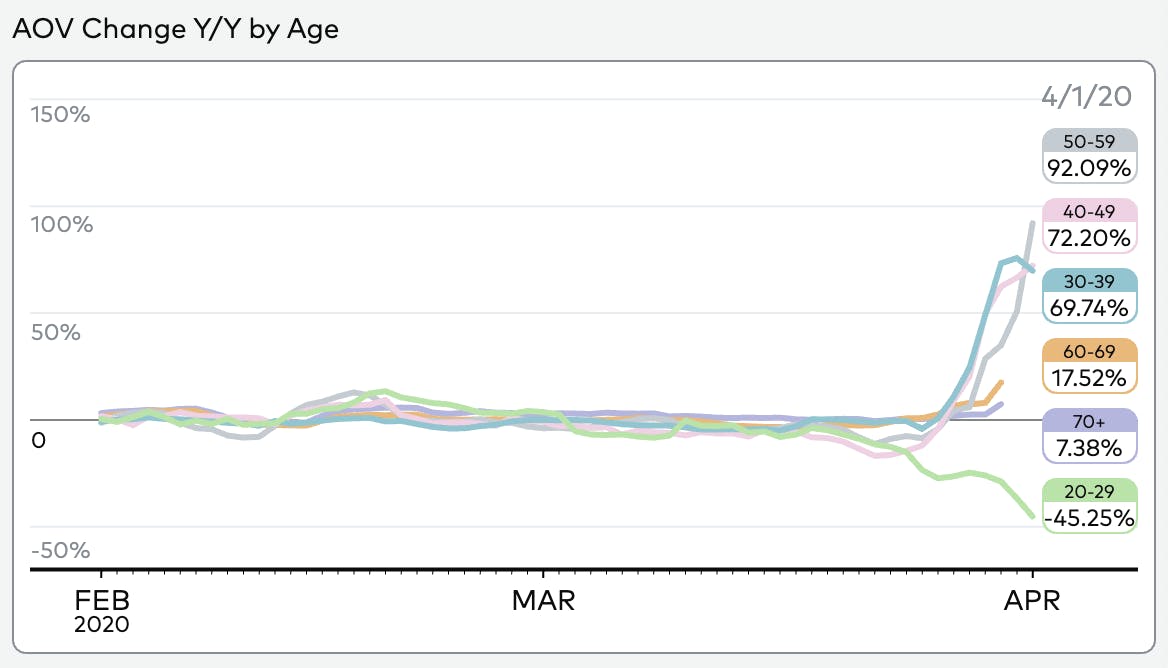

Women and customers aged 60+ outperform other demographic groups Y/Y. Middle-aged women have been more receptive to sales, resulting in growth in basket size (but not growth in orders). Meanwhile younger customers are using these discounts for small, targeted purchases. And customers aged 60+ have stronger Y/Y revenue compared to younger customers.

Announcing New Data: Age and Gender

Amperity recently added age and gender breakdowns to the Retail Monitor, allowing for demographic analysis of the impact to revenue, customer retention, and more. These new views bring to light how the effects of the COVID-19 pandemic on purchasing varied by different demographic groups.

Age

Customers in their 30s-50s were mainly responsible for the temporary “shift” to e-commerce and have been the most responsive to site-wide sales. Revenue from older customers (60+) are the least affected, and younger customers are limiting overall spend while they take advantage of sale prices.

Across our benchmark of ~100 retail brands, the COVID-19 crisis drove a short-lived increase in e-commerce revenue followed by rapid overall decline, with better relative performance on mobile and recent strength on social.

It may be surprising that customers in their 20s were not the driver in the shift to e-commerce, but this is likely because they were already more likely to shop online. Instead, customers in their 30s-50s were responsible for the initial shift. And data show that some customers aged 60+ started to move online for the first time during this period.

As schools shut down and businesses began closing retail stores in mid-March, customers under 60 all experienced rapid decline. The upheaval in this group was particularly extreme: they quickly transitioned to home-schooling their kids, began working from home when possible, started putting care plans in place for at-risk members of their family, and may have been put on furlough.

Customers aged 60+ have shown significantly better performance and could represent a bright spot for retailers looking to find opportunities for growth. And recently, customers aged 30-50 (and women in particular) are responding to recent site-wide sales by increasing their basket size. Younger customers (aged 20-29) reacted differently, choosing instead to take advantage of lower prices to buy 1-2 products they needed, rather than increasing their overall basket size.

Gender

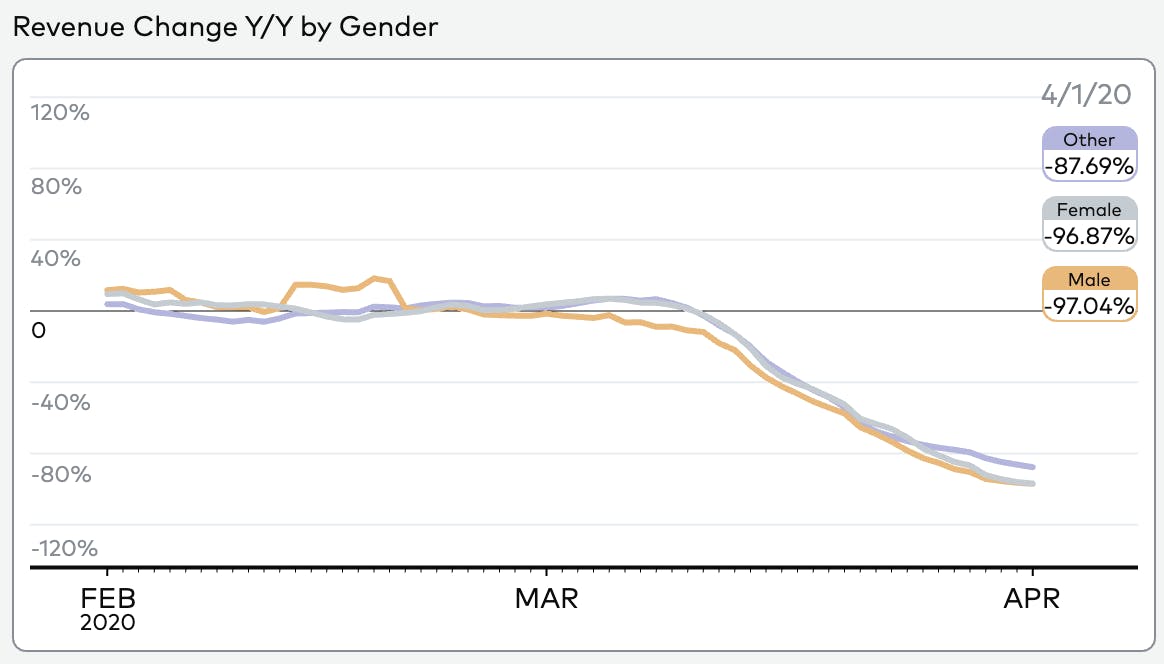

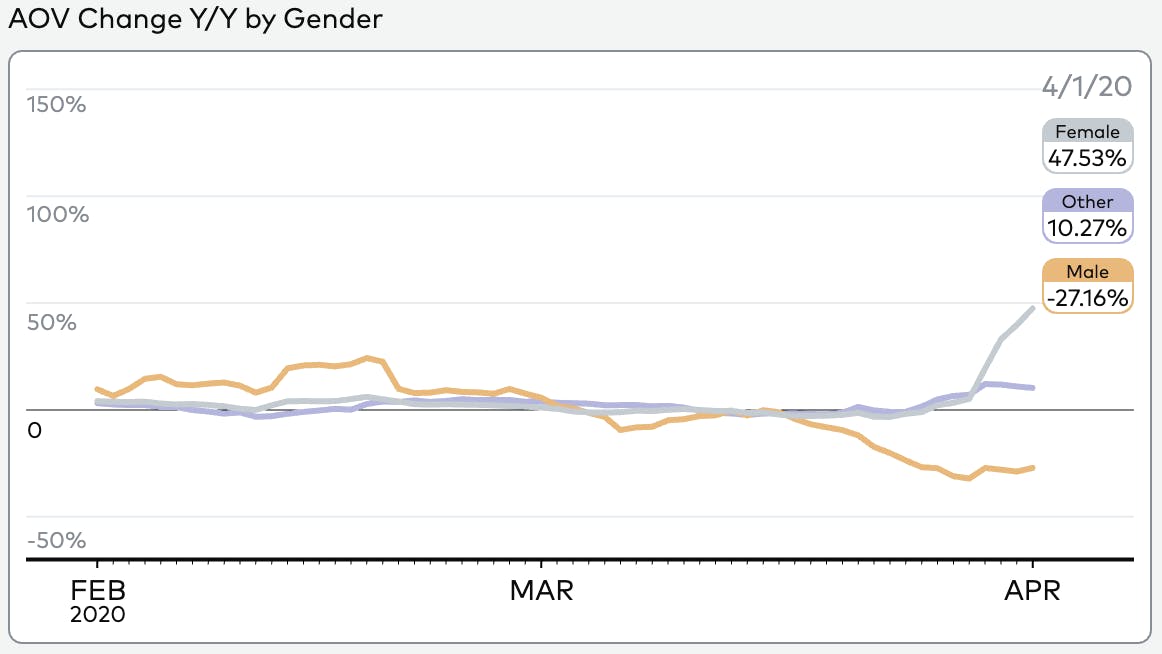

Women took longer to decline than men and have been more receptive to sales, resulting in growth in basket size (but not in number of orders)

As the crisis unfolded, men were the first to show signs of decline. Women also declined but consistently performed ~8-10% better than men until late March, when their downward trends converged.

As brands began leaning back into digital ad spend to promote e-commerce discounts, women have taken advantage of lower prices to increase their basket size significantly more than men. But while this trend is promising, it is unclear whether total revenue and orders will show similar upticks (or even decelerate the overall decline). That means that while they can infuse some much needed demand and alleviate pressing inventory problems, these discounts may not be incentivizing incremental orders at scale.