We built a dynamic tracker to analyze the impact of the pandemic on retail, using data from more than 100 North American brands. We'll be sharing updates and new insights on a regular basis. You can find our first installment recapping data from the past few months here and last week's update introducing new demographics around age and gender here.

July 2021 update: we've now sunsetted the Retail Monitor so it is no longer accessible.

Three new insights for this week:

The shift to mobile has buffered declines in e-commerce

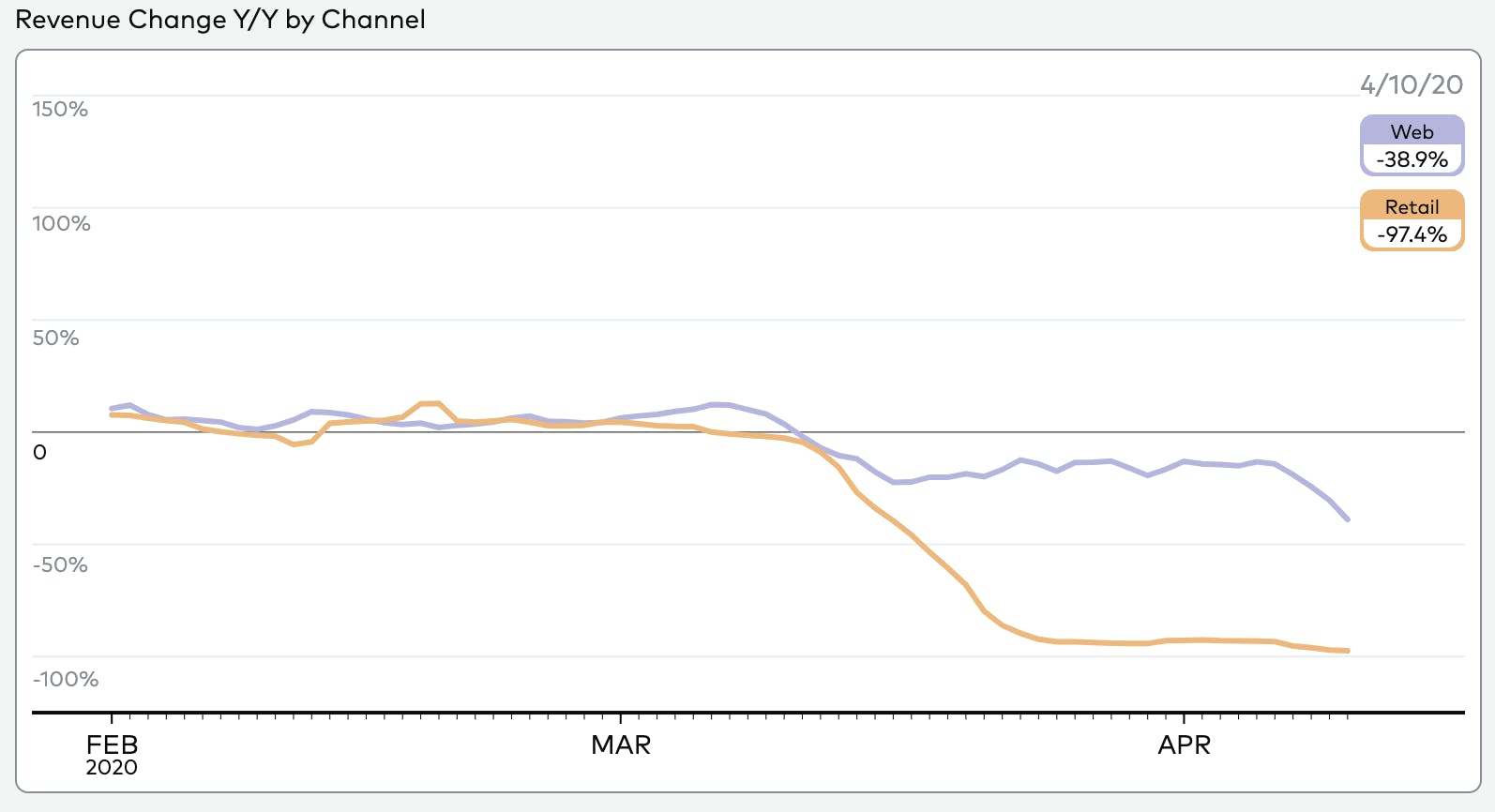

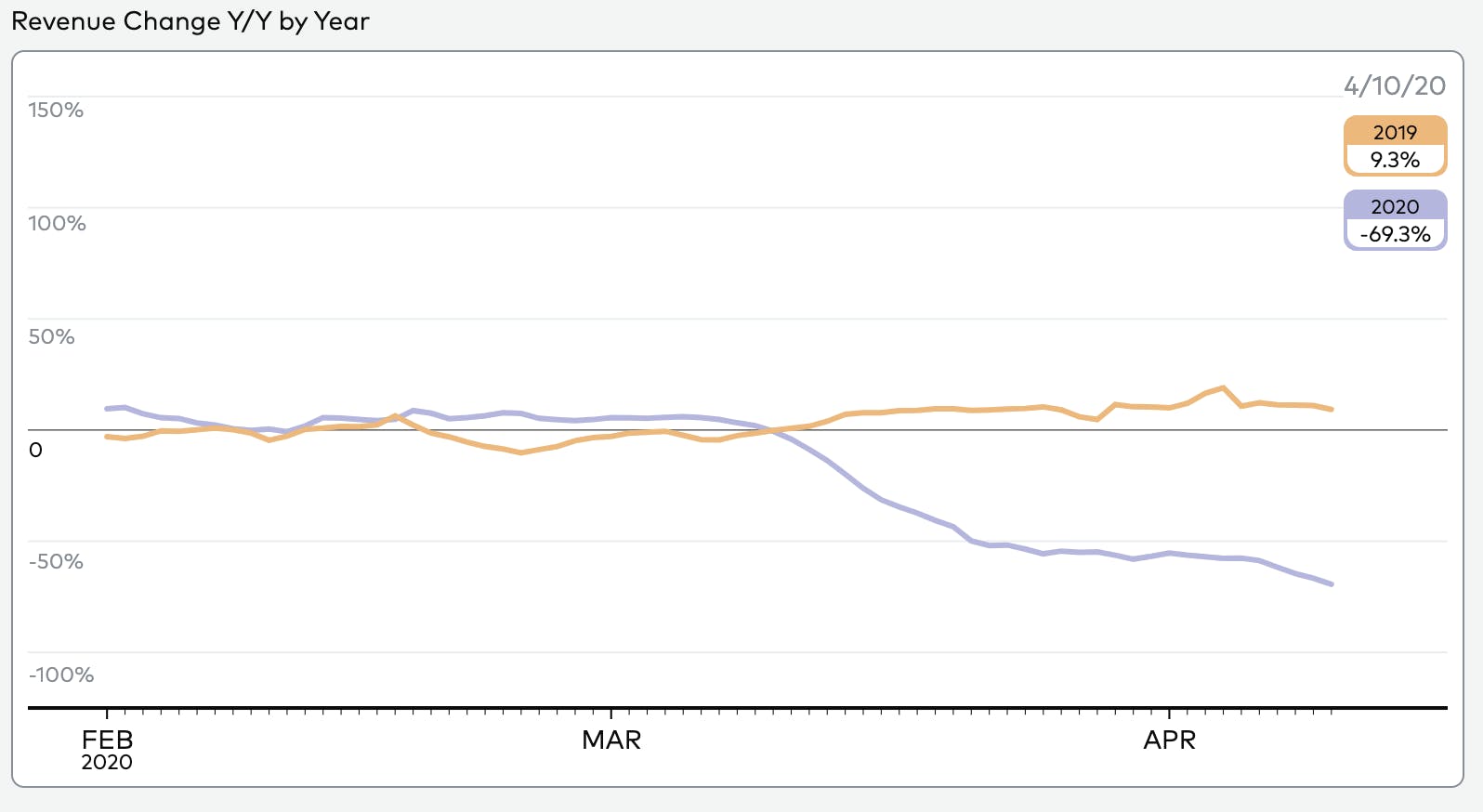

Overall retail demand has fallen 69% Y/Y, but online purchasing was only down ~38% at the end of the week. This is mainly the result of strong mobile performance — as customers spend more time on their phones, mobile was actually trending up Y/Y. Mobile has been particularly successful in driving new customers to purchase — the channel has consistently outperformed non-mobile by ~60% over the past several weeks.

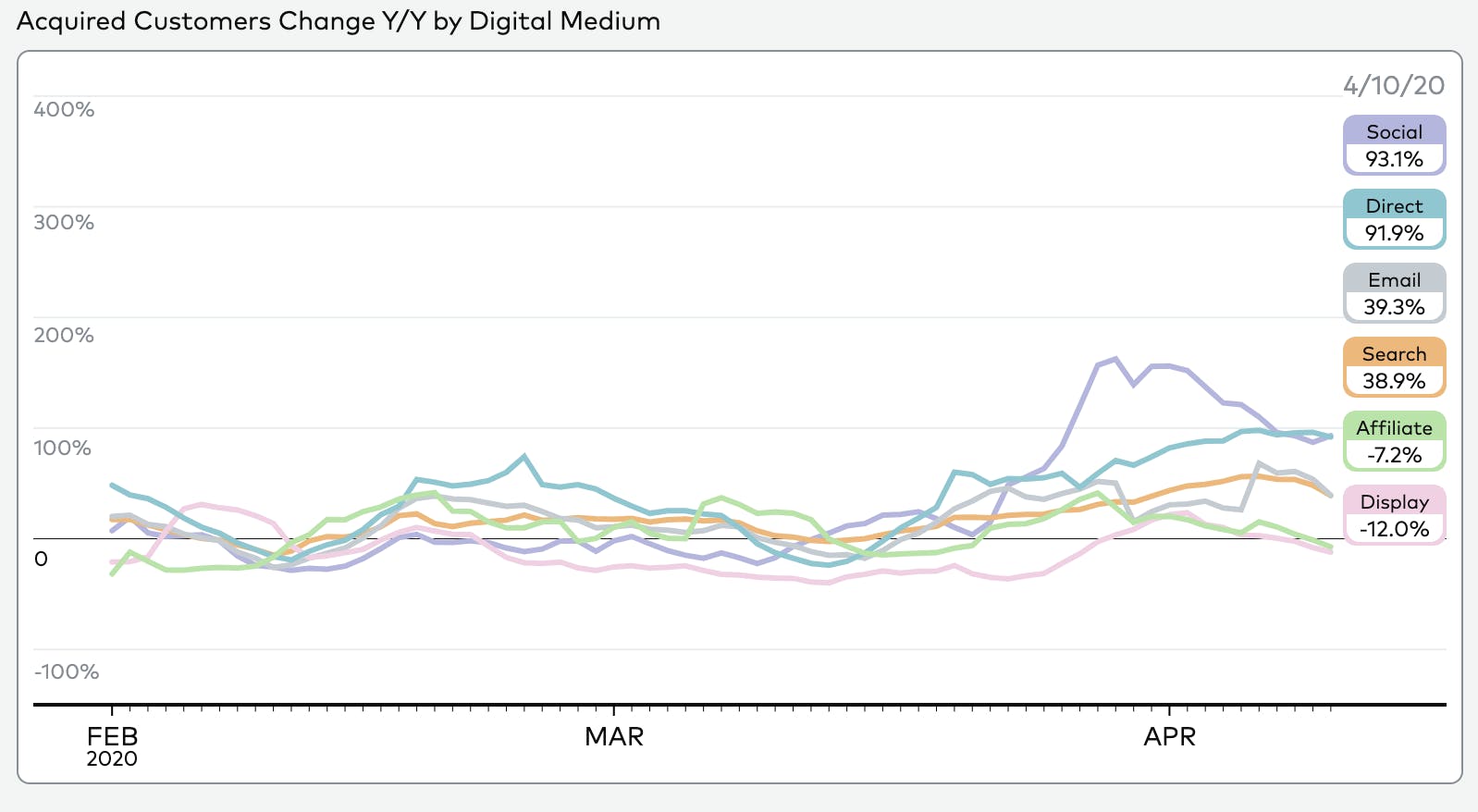

Social remains the most effective non-direct digital medium

The Y/Y revenue growth from social has cooled off from its high near the end of March, but is still up Y/Y and outperforming other paid channels. Social has also been an effective source for customer acquisition as brands experiment with messaging for giving campaigns and deep discounts to convert customers who are just now engaging online (+93% Y/Y).

Customers in their 20s aren’t coming back soon, but middle-aged women are still engaging with brands (especially when there’s a sale)

The earlier trend continues - Middle-aged women have been more receptive to sales, resulting in growth in basket size (but not growth in orders). Meanwhile younger customers are using these discounts for small, targeted purchases. One possible explanation - early unemployment trends show that the jobless rate rose most significantly for those between 20-24.